| 1. |

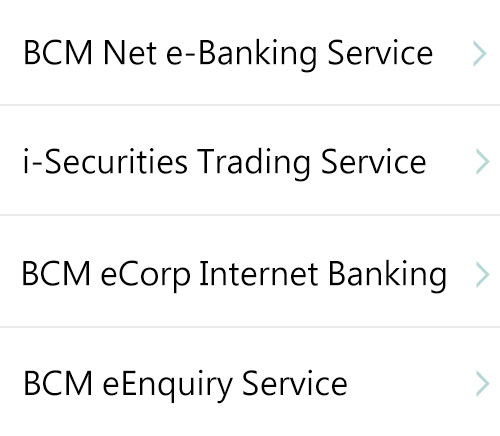

Selected customers have to successfully apply for the BCM BUZZ Credit Card (“Credit Card”) of Banco Comercial de Macau, S.A. (“BCM”) between 5 November 2025 and 28 February 2026, with both dates inclusive (“Promotion Period”), in order to enjoy the First Transaction Reward and Accumulated Spending Reward (“Promotion”). |

| 2. |

This Promotion is only applicable to the selected customer who has completed the registration on the designated BCM website’s registration page on or before 28 February 2026, and successfully applied for the Credit Card (“Credit Cardholder”). |

| 3. |

First Transaction Reward – Cardholder who has successfully applied for BUZZ Credit Card can enjoy MOP100 cash rebate upon your first transaction within the first two months of card issuance. |

| |

3.1 Cash rebate will be credited directly to the relevant Credit Card within 4 - 6 weeks after the completion of the relevant transactions. |

| 4. |

Accumulated Spending Reward - Within the first two months of card issuance, cardholder who has accumulated spending of MOP6,800 or more with his/her BUZZ Credit Card can enjoy HKD600 Digital Voucher at Klook.com. |

| |

4.1 The total HKD600 Klook cash coupons include one “Hotels” cash coupon of HKD300, one “Tours & Experiences” cash coupon of HKD200, and one “Car Rentals” cash coupon of HKD100. The validity of the cash coupons is until 31/12/2026. |

| |

4.2 The cash coupons will be delivered in the form of unique discount code to eligible Credit Cardholders within 4 to 6 weeks after the designated spending amount is fulfilled. |

| |

4.3 The relevant cash coupons are not transferable or redeemable for cash. Customers must keep their unique discount codes safe, report loss of the discount code(s) will not be accepted. BCM is not obliged to re-issue the discount code. |

| 5. |

The following transaction types are excluded from the Promotion: any Credit Card installment program, Macau Pass and MPay related transaction, casino chips, gambling nature transactions, balance transfer, autopay, credit card annual fee, charges, handling fee, interest or financial charges, mail orders, telephone purchase orders, cheque payment, late fee, unposted/cancelled/refunded and unauthorized transactions, plus any other transaction defined by BCM from time to time. |

| 6. |

Spending on the Principal Card and Supplementary Card will be individually calculated. |

| 7. |

Each Credit Cardholder can enjoy the Approval Offer and Welcome Offer only for ONE time disregards the number of BCM Credit Card he/she possesses/applied. |

| 8. |

Cardholder who has been rewarded the Accumulated Spending Reward and terminates the BCM Credit Card within 12 months from card issuance, the handling charges of HKD600 will be debited from the Cardholder’s account. |

| 9. |

BCM is not the cash coupons supplier and will not be responsible for the quality and any matters in relation to the services or products. Customer should follow the relevant terms and conditions of Klook Travel Technology Limited when using the cash coupons. Cardholders should resolve such issues directly with the supplier. |

| 10. |

Cardholders should maintain valid BCM Credit Card and with good financial status in order to entitle to the Promotion. |

| 11. |

If the Credit Card or any related transaction is found cancelled or ineligible, which had been calculated for the Promotion after the cash rebate/cash coupon has been collected, and resulted in the transactions failing to meet the required spending amount of the Approval Offer and/or Welcome Offer, BCM has the right to debit the value of the Cash Rebate from the relevant Credit Card account or any other bank account possessed by cardholder in BCM in case the Credit Card account is invalid without prior notice. |

| 12. |

The offers are offered on first-come-first-served basis. |

| 13. |

This service/product is not targeted at customers in the EU. |

| 14. |

BCM reserves the right to amend any of these Terms and Conditions without prior notice. |

| 15. |

If this English version of the terms and conditions does not conform to the Chinese version, the Chinese version shall prevail. |